Product Details

Cong xi jie shang kuan dao ai guo gong zhai xi shuo zao qi Zhongguo dui nei gong zhai 1894-1949 From Interest-bearing Merchant Loans to Patriotic Government Bonds: A Detailed Look at Early Chinese Domestic Debt, 1894-1949

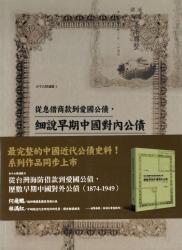

從息借商款到愛國公債 細說早期中國對內公債 1894-1949-

Product Details

- Product #

- Author(s)

- Dai, Xuewen

- City

- Taibei

- Country

- Taiwan

- Language

- Chinese (simplified)

- ISBN

- 9789864773015

- Date of Publication

- 2017

- Publisher

- Cover Type

- Soft cover

- Pages

- 316

- Series

- Subject

- History, 19th Century and Earlier

- Subject

- History, 20th-21st Centuries

-

Product Details in Original Language

- Author

- Publisher

-

Description

- From Interest-bearing Merchant Loans to Patriotic Government Bonds: A Detailed Look at Early Chinese Domestic Debt, 1894-1949 The only rare collection of historical materials on government bonds in the publishing industry. In 1894, on the eve of the First Sino-Japanese War, the Ministry of Revenue, imitating the "borrowing foreign loans with interest" method, began "borrowing commercial loans with interest." This marked the first time the Chinese government issued domestic bonds in the form of bonds. Although purportedly modeled on Western methods, borrowing commercial loans with interest, like subsequent domestic bonds, involved no contractual agreement between the borrower and the lender. Instead, they were based on officially drafted and amendable charters. Early Chinese domestic bonds, due to a faltering domestic economy and immature issuance conditions, could not be successfully raised on the open market. Consequently, they were often levied, allocating quotas and forcing citizens to subscribe, acting as if they were a new tax. This practice persisted even in the 1950s, when the Nationalist government issued the 38-year Patriotic Bonds in Taiwan. These levies often yielded less than ideal amounts, sparking significant public discontent. However, in a China plagued by chronic instability and financial difficulties, these bonds were a difficult proposition to part with. In his forties, the author of this book resigned from all his jobs to dedicate himself to the study of modern Chinese monetary and financial evolution, focusing primarily on Chinese silver ingots, banknotes, and bonds. He visited antique markets, auction houses, research institutions, and libraries, and also worked with professional foreign trading agencies. Over the course of more than a decade, he has become a leading figure in this field in China and is highly regarded. This book, along with "From Taiwan Coastal Defense Loans to Patriotic Bonds: A Chronicle of Early Chinese Foreign Debt (1874-1949)," is part of a series. Both books share the following characteristics: 1. Completeness: Chronologically listing each issuance, starting with the earliest bonds.

-

Wish listBuy now

He bi zhan nan : ba nian kang zhan de an liu- Prod#:

- 2262167B

- Taiwan; Taibei: Zheng da chu ban she, 2017

- Chinese (simplified)

Wish listBuy now

Jiao ke shu li mei you de Minguo shi- Prod#:

- 2262169B

- Taiwan; Taibei: Da qi chu ban she, 2017

- Chinese (simplified)

Wish listBuy now

Zou xiang bian yuan de wai jiao lu : wei yuan zhang de 1940- Prod#:

- 2262328B

- Taiwan; New Taipei City: Ling huo wen hua shi ye you xian g..., 2017

- Chinese (simplified)

- }